The FIRE movement, short for Financial Independence, Retire Early, has become a popular way for people to rethink their careers and money. The idea is simple: save and invest enough so that work becomes optional, giving more freedom and flexibility in life.

While the dream of early retirement sounds exciting, not everyone wants to live on a tight budget or work 70 hours a week just to quit at 40. That’s why new paths within the FIRE movement have appeared. These include Lean FIRE, Fat FIRE, Coast FIRE, and Barista FIRE. Each path offers a different balance between saving, working, and enjoying life.

This article focuses on Coast vs Barista FIRE. Both are hybrid approaches to financial independence, but they work in very different ways. Coast FIRE means saving heavily at first and then “coasting” to retirement, while Barista FIRE means reaching partial freedom by covering expenses with a part-time job while investments grow in the background.

What is Coast FIRE?

Coast FIRE happens when someone builds a large enough investment portfolio early in life. That portfolio, if left alone, will grow enough to support retirement later without needing new contributions.

People on this path save aggressively in their 20s or 30s. Once their diversified portfolio is strong enough, they stop saving for retirement and only cover current living costs with regular income. Their investments do the heavy lifting by compounding over time. It is ideal for those with a stable income level early in their careers or people who have had a successful business exit and want to take their foot off the gas. It’s best for planners who value freedom from strict saving later in life.

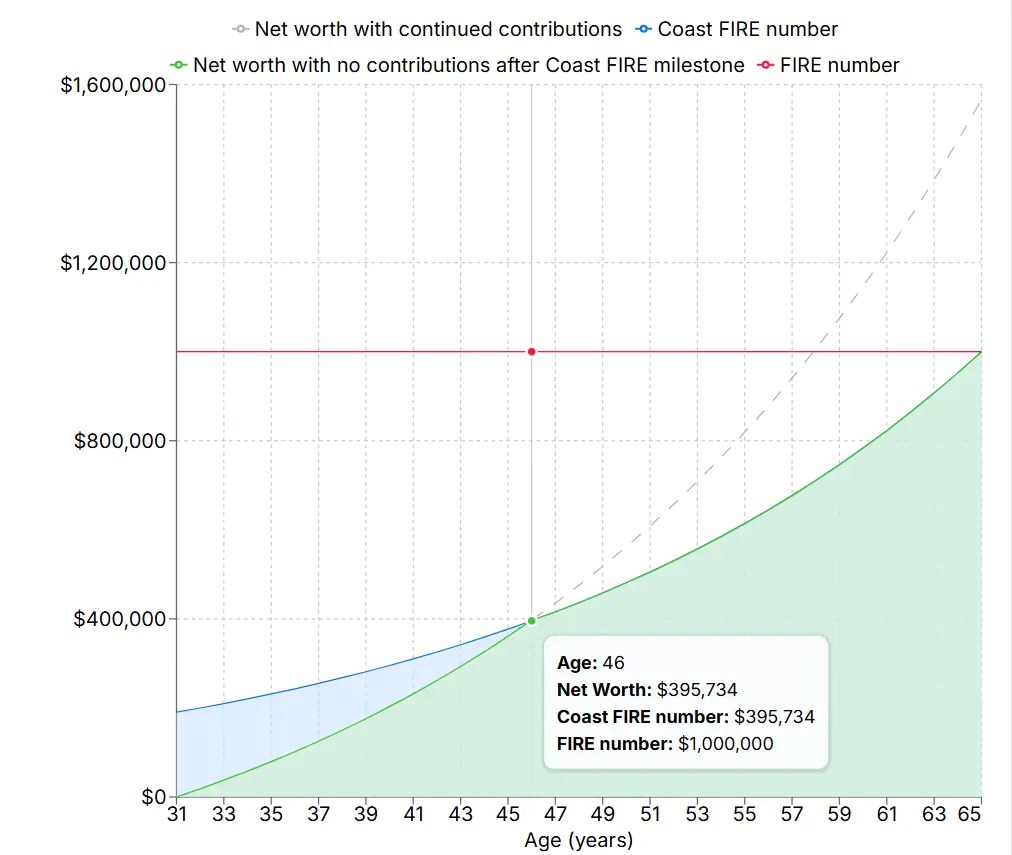

After an initial period of heavy saving, you can sit back and allow compound interest to do the heavy lifting. Although this varies from case to case, we’ll illustrate this approach with a simple example using a Coast FIRE calculator.

Suppose you discover Coast FIRE at age 31. You like your job, so you plan to work until age 65. You expect to need about $40,000 per year in retirement. Using the 4% rule, your financial independence number would be $1,000,000 ($40,000 ÷ 0.04). Let’s assume your household saves and invests $1500 every month during an initial intensive savings phase. With an 8% annual return, you could reach Coast FIRE in only 15 years, at age 46.

What does this mean? From age 46 onward, you no longer need to save for retirement. You only need to cover current living expenses from your salary while your investments compound in the background.

What is Barista FIRE?

Barista FIRE is a middle ground between Lean and Fat FIRE. With this approach, a person has saved enough to reduce financial pressure but still needs some income from a part-time job or freelance work.

Instead of stopping work entirely, Barista FIRE followers choose a lighter, more enjoyable job, sometimes with benefits like health insurance. For example, someone may pick up a side hustle or work at a coffee shop while their savings continue to be invested and grow. This model works well for people who value flexibility but also want the safety net of income and benefits. It’s especially appealing to families or those who aren’t ready to fully depend on investments.

Imagine someone, Alex, who is 35 years old and has built an investment portfolio of $400,000. Alex’s goal is to retire fully at 60 with $1,000,000, which would support a $40,000 annual withdrawal using the 4% rule. Instead of saving aggressively for another 25 years, Alex chooses Barista FIRE. By moving to a lower-stress part-time job, Alex earns $25,000 annually, which covers most living expenses, including healthcare benefits.

Meanwhile, Alex’s $400,000 portfolio stays invested, growing at an average of 6% annually. With no withdrawals during these working years, the portfolio compounds steadily, reaching close to the $1,000,000 target by age 60, even without large new contributions.

Coast vs Barista FIRE: Key Differences

- Income Needs: Coast FIRE requires strong early savings, while Barista FIRE depends on steady part-time income later.

- Work Commitment and Lifestyle Flexibility: Coast FIRE allows minimal work, while Barista FIRE still involves regular freelance work or a job.

- Healthcare and Benefits Considerations: Barista FIRE often provides access to employer benefits like health insurance. Coast FIRE usually requires buying coverage independently.

- Financial Risks and Safety Nets: Coast FIRE risks are tied to market performance. If markets underperform, the plan may fall short. Barista FIRE carries less investment risk but more reliance on continued work.

Pros and Cons of Coast & Barista FIRE

| Coast FIRE | Barista FIRE | |

| Advantages | • No need to save aggressively later in life • Greater work flexibility • Investments grow without new contributions | • Healthcare coverage from a part-time job • Extra income makes life more comfortable • Flexible work, like a side hustle, adds freedom |

| Disadvantages | • Healthcare coverage from a part-time job • Extra income makes life more comfortable • Flexible work, like a side hustle adds freedom | • True early retirement isn’t possible right away • May limit travel or leisure time • Less appealing for those seeking complete freedom |

How to Decide Which FIRE Path is Right for You

Choosing between Coast FIRE and Barista FIRE depends on your financial situation, goals, and comfort with risk. While both paths aim for financial independence, they go about it in very different ways. Here are the main areas to think about:

- Assessing Your Savings Progress

If you’ve already built a strong investment portfolio early in your career, Coast FIRE may be easier to achieve. It allows you to stop saving and simply cover your everyday expenses through your salary. On the other hand, if you haven’t built enough savings yet, Barista FIRE can bridge the gap by using part-time or flexible work while your portfolio continues to grow. - Evaluating Risk Tolerance

Coast FIRE relies heavily on the power of compounding. If markets underperform, it may take longer to reach your retirement number. People who prefer more certainty may find Barista FIRE less stressful, since a part-time job or side hustle provides steady cash flow. - Considering Family, Healthcare, and Lifestyle Goals

Families often value healthcare benefits from Barista FIRE jobs, while singles or couples without children may prefer the freedom of Coast FIRE. Think about whether you’d rather have guaranteed healthcare and income now, or more free time later.

Can You Combine Coast and Barista FIRE?

Some people blend the two models. For example, they may save heavily early (Coast FIRE) but still choose to do freelance work or a fun job (Barista FIRE).

Similarly, it is also possible to start with Barista FIRE for safety and later move into Coast FIRE once investments have grown enough. Imagine someone in their 30s with a strong portfolio but still doing freelance work or a side hustle. Over time, they may stop working altogether and coast into retirement.

Conclusion

Young professionals with high early savings may find Coast FIRE more achievable. Those with families or lower savings may prefer Barista FIRE for stability.

When it comes to Coast vs Barista FIRE, there’s no single right answer. The best choice depends on goals, lifestyle, and personal values. Whether someone chooses to build wealth early or mix work with freedom, the end goal remains the same: more control over time, money, and life.

FAQs

Can Coast FIRE eventually turn into Fat FIRE?

Yes, if investments perform very well, a Coast FIRE plan could grow into Fat FIRE, supporting a more luxurious lifestyle.

Is Barista FIRE realistic for families with children?

Yes, especially if the parents can find part-time jobs with benefits or run a successful business that provides a steady income.

What if the market underperforms during Coast FIRE?

This is a risk. A weaker market may delay retirement unless extra savings or work are added.

Which FIRE option gives more flexibility long term?

Barista FIRE may feel safer because of income and benefits, but Coast FIRE provides greater long-term freedom once the investments mature.

Want more tips? Get new post notifications emailed to you.

Welcome to Financial Freedom Journey!

If you liked this article, then please subscribe to our Youtube Channel and also you can find us on Twitter, Instagram, Pinterest, and Facebook.